How To Ensure Legal Compliance Before Starting An SMB

Starting a small business is an exciting venture, but it can also be intimidating. Countless legal considerations need to be taken into account before you start your business. From tax obligations to permits and licenses, many steps must be followed for your business to remain compliant with the law. We’ll guide how to ensure legal compliance when starting a small business by discussing topics such as registering your company with the IRS, obtaining necessary permits and licenses, understanding employment laws, and more. With this information in hand, you can confidently take the first step toward launching your own successful small business!

Deciding On Your Legal Structure

The first step in ensuring legal compliance is determining the appropriate business entity for your small business. Common options include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own set of legal obligations that you must abide by. Discussing your situation with a knowledgeable attorney can help you make the best decision for your particular needs. Deciding on a self-employed vs limited company will depend on how much liability you want to take on, as well as the amount of paperwork and tax implications associated with each option. And while sole proprietorships are the simplest legal structure, LLCs and corporations may provide additional protections against personal liability.

Registering with IRS

Registering your business with the Internal Revenue Service (IRS) is also a crucial step to ensure legal compliance. Depending on your chosen business entity, you’ll need to select an Employer Identification Number (EIN), register for taxation purposes, and complete the appropriate paperwork to become compliant with federal laws. Additionally, you should determine whether you need to pay estimated taxes each quarter or be subject to withholding taxes from employees’ wages. Some states also have additional registration requirements, so be sure to check with your state government to make sure you’re following all the necessary procedures.

Obtaining Permits and Licenses

In addition to registering with the IRS, you will likely need various permits and licenses to operate legally. Some of the most common include sales tax licenses, business permits, zoning permits, building permits, health permits for food businesses, alcohol licenses for bars or restaurants, professional licensing for skilled trades such as doctors and lawyers, and more. Reach out to your local government office or search online for a comprehensive list of required permits and licenses in your area.

- For some business owners, understanding and following employment laws can be tricky. As an employer, you must understand the relevant laws about hiring employees as well as managing payroll taxes, overtime requirements, and other related topics. It’s also important to familiarize yourself with labor laws such as minimum wage regulations, health and safety requirements, anti-discrimination guidelines, and more. Additionally, make sure you’re in compliance with state unemployment insurance laws and are aware of any applicable collective bargaining agreements that may apply to your business.

Understanding Employment Laws

If you plan on hiring employees for your business, it’s important to understand the applicable employment laws. At a minimum, you must comply with federal and state laws regarding wages, hours, discrimination, safety and health standards, unemployment insurance taxes, workers’ compensation insurance policies, payroll taxes, and more. Additionally, some states have additional requirements for employers. For example, California has specific regulations regarding employee breaks and paid sick leave. Be sure to do your research on all applicable employment laws before hiring any employees.

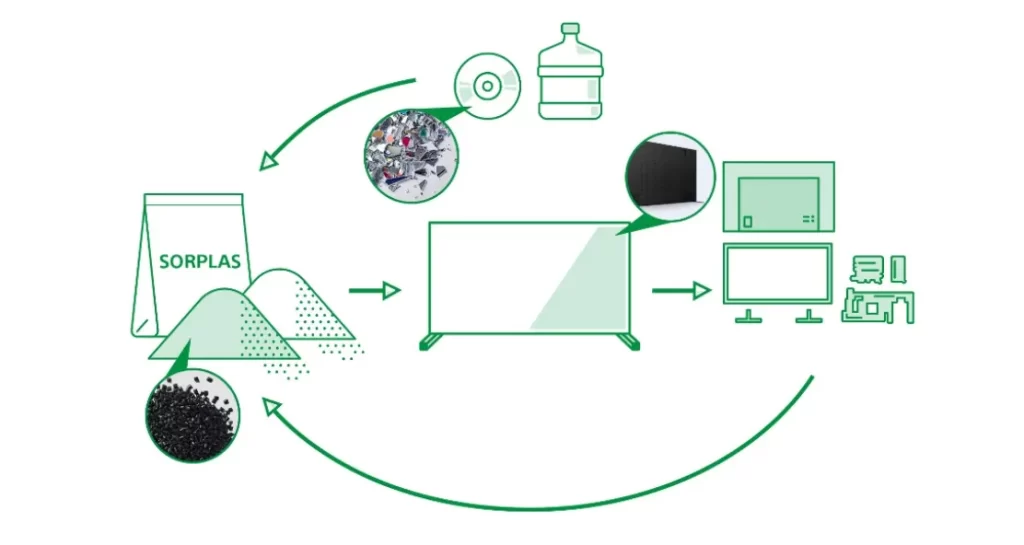

Keeping Accurate Financial Records

Accurately tracking and recording your business finances is another important step to ensure legal compliance. The IRS and other government agencies require businesses to keep detailed records of their financials for tax purposes, so you must maintain accurate accounting books. Additionally, regularly auditing your financial records can help identify potential problems before they become bigger issues. This will also provide a clear picture of what’s working (and what isn’t) as you grow your business.

- Cashflow Statements: These documents show inflows and outflows of money, allowing you to track how much cash is coming in each month and which activities are producing the most revenue. Make sure to track your cash flow closely so you can quickly respond to changes in the marketplace.

- Income Statements: This document shows how much money a business earned and spent during a given period of time. It’s important to track this information closely as it will provide insight into how profitable the business is and reveal areas where expenses should be cut or investments should be made.

- Balance Sheets: A balance sheet provides an overview of the company’s assets, liabilities, and equity at any given point in time. Reviewing these documents regularly allows you to track changes in value over time, which could indicate potential problems with liquidity or solvency that need to be addressed.

- Tax Returns: Every year businesses must file tax returns with the IRS. It’s important to keep accurate records of your financials throughout the year to make filing taxes easier and more efficient. A good accounting system can help ensure that all necessary information is gathered and reported accurately when it comes time to file.

Understanding Intellectual Property Laws

Lastly, if you’re creating something original or using someone else’s work, intellectual property laws must be taken into account. Copyright law protects original works such as songs, books, paintings, or sculptures and trademark laws protect things such as logos, names, slogans, and other identifiers. If you’re using someone else’s work, it’s important to be aware of any applicable licensing requirements. Additionally, creating an intellectual property protection plan is a wise course of action if you have any original works that you want to protect.

Staying compliant with applicable laws and regulations is an essential part of running a successful business. Being familiar with the various categories of relevant laws, such as employment, financial, and intellectual property law, will help ensure that your business remains in compliance. Additionally, regularly auditing your finances and creating an intellectual property protection plan can provide additional peace of mind. Taking the time to understand these legal requirements now can save you time and money down the road.